GDP surge driving India's growth story

ANI

31 Aug 2025, 00:38 GMT+10

New Delhi [India], August 30 (ANI): India's strong services activity has helped GDP growth comfortably beat expectations for the second quarter in a row, rising to an impressive high of 7.8 per cent for April-June 2025.

India's economy grew at a faster-than-expected annual rate in the quarter to the end of June, boosted by the manufacturing, construction and service sectors.

The swift growth in the first quarter of the current financial year further consolidates India's position as the world's fastest growing major economy, officials said.

Currently the world's fourth-largest economy, India is on track to become the third-largest by 2030 with a projected USD 7.3 trillion GDP. This momentum is powered by decisive governance, visionary reforms, and active global engagement, they said.

Notably, growth is accelerating, with real GDP expected to rise by 7.8% in Q1 FY 2025-26, up from 6.5% a year earlier.

The ascent is powered by strong domestic demand and transformative policy reforms, making India a prime destination for global capital, officials said. With easing inflation, higher employment, and buoyant consumer sentiment, private consumption is expected to further drive GDP growth in the coming months.

Gross Domestic Product (GDP) reflects the size and health of an economy by capturing the total value of goods and services produced within a country. Real GDP, which measures the economy's output after removing the effects of inflation, grew by 6.5% in Q1 of 2024-25. In Q1 of FY 2025-26, real GDP is estimated at Rs 47.89 lakh crore, against 44.42 lakh crore in Q1 of FY 2024-25, depicting an impressive growth of 7.8%.

In Q1 of FY 2025-26, allied sector, comprising agriculture, livestock, forestry and fishing and mining and quarrying grew by 3.7%, up from 1.5% in the prior corresponding period.

Secondary sector, comprising manufacturing, electricity, gas, water supply & other utility services and construction posted strong gains, with manufacturing (7.7%) and construction (7.6%) both crossing the 7.5% growth mark.

Tertiary sector recorded a robust 9.3% growth at constant prices, higher than 6.8% in Q1 FY 2024-25.

'In our view, Q1 numbers reflect the basic resilience of our economy. It reflects strengthening of the momentum in the economy and it is anchored in strong macroeconomic fundamentals. On the supply side, we have seen an all-round growth. On the manufacturing, construction and service side activity, as well as the fact that agriculture side has shown a robust growth,' Anuradha Thakur, Economic Affairs Secretary said on Saturday.

'The rabi harvest as well as kharif sowing have been much in excess of the last quarters. We have a good buffer stock. We have had a good rainfall...On the demand side the primary drivers have been domestic and in our economy, net exports don't contribute so much on the demand side,' she added.

The sharp pick-up in growth in April-June 2025 has been catalysed by the services sector growth hitting a high of 9.3%. All components of the services sector, such as trade, hotels, transport, communication and services related to broadcasting, financial, real estate & professional services and public administration, defence & other services have been on an upward trajectory. GVA growth, which is seen as a more meaningful measure of activity levels, registered a high of 7.6% in April-June 2025. GVA is arrived at by subtracting net indirect taxes, indirect taxes after adjusting for subsidies - from the GDP.

Notably, India is projected to reach a GDP of Rs. 4,26,45,000 crore (US$ 5 trillion) by 2027 and is on course to surpass Germany by 2028. By 2030, India is set to become the world's third-largest economy with a projected GDP of $7.3 trillion.

GST has also promoted price convergence across states, strengthening its role as a national equaliser. Looking ahead, next-generation reforms will be launched in October 2025, aimed at reducing taxes on essentials, easing MSME compliance, and creating a more transparent, citizen-friendly tax system.

Inflation situation has shown consistent improvement in the country. In July 2025, India's inflation depicted a clear decline which suggests an increase in the purchasing power, providing relief to households and indicating stability in the economy.

India's job market has undergone a profound transformation, mirroring the country's economic evolution from a largely agrarian economy in the pre-independence era to a globally integrated, technology-driven one today, officials said.

Over the decades, employment patterns have shifted in tandem with structural changes in the economy, with the workforce gradually moving from agriculture to industry and, more recently, to services and knowledge-based sectors.

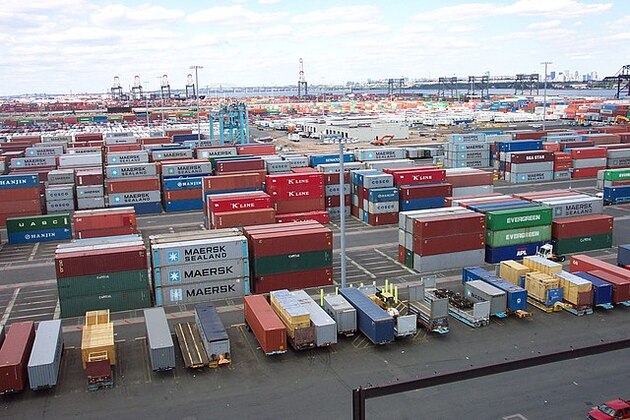

India has rapidly emerged as a top global destination for Foreign Direct Investment (FDI), powered by a decade of structural reforms, investor-friendly policies, and rising competitiveness. Backed by improvements in global rankings and strategic initiatives, investor confidence has strengthened. India witnessed a historic USD 81 billion worth of foreign investments in FY24-25 alone.

The Government now targets annual FDI inflows of USD 100 billion, up from the five-year average of over USD 70 billion, as India positions itself as a global investment hub amid shifting supply chains.

Additionally, India's foreign exchange reserves stood at USD 695.5 billion as of July 18, 2025, having briefly crossed the USD 700 billion mark in the week ending June 27, 2025.

Backed by these strong macroeconomic fundamentals, India's growth journey remains in the global spotlight.

The International Monetary Fund (IMF) also followed suit, and revised its forecast for India's economic growth to 6.4% for both 2025 and 2026. Earlier in its April 2025 World Economic Outlook, IMF had projected India's GDP growth at 6.2% for 2025 and 6.3% for 2026.

S&P Global raised India's long-term sovereign credit rating to 'BBB' from 'BBB-', with the short-term rating upgraded to 'A-2' from 'A-3'. The transfer and convertibility assessment has also been improved to 'A-' from 'BBB+', recognising India's growing financial resilience. S&P had last upgraded India in January 2007 to 'BBB-', hence, this rating upgrade comes after an 18-year gap.

As per S&P Global, real GDP growth averaged 8.8% between FY22 and FY24, the highest in the Asia-Pacific region. S&P further projects GDP growth of 6.5 per cent in FY26 and 6.8% over the next three years.

Most recently, Fitch Ratings affirmed India's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'BBB-' with a stable outlook, owing to India's strengthening record of delivering growth with macro stability and improving fiscal credibility. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dallas Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dallas Sun.

More InformationInternational

SectionEnvoys return as India-Canada relations mend after Nijjar killing

OTTAWA, Canada: India and Canada have restored diplomatic ties by appointing new high commissioners to each other's capitals, ending...

“Do no harm”: Three top CDC officials resign over vaccine concerns

WASHINGTON, D.C.: Three senior officials at the U.S. Centers for Disease Control and Prevention resigned this week, citing deep concerns...

Wife of ousted South Korean president, ex-PM indicted

SEOUL, South Korea: South Korea's former First Lady Kim Keon Hee and ex-Prime Minister Han Duck-soo were both indicted on August 29...

Verdict of media tycoon Jimmy Lai to be announced at later date

HONG KONG: A Hong Kong court has said it will announce the verdict in media tycoon Jimmy Lai's national security trial at a later date,...

Landslides in Kashmir leave pilgrims missing, floods in Pakistan

NEW DELHI/ISLAMABAD: Torrential rains pounding parts of Pakistan and India have left a trail of destruction, killing at least 34 people...

Trump plans overhaul of Washington’s flagship rail hub, Union Station

NEW YORK CITY, New York: The U.S. Transportation Department has announced plans to take back control of Washington's Union Station,...

Business

SectionWall Street kicks off September with a limp,

NEW YORK, New York - U.S. stocks fell Tuesday, the first trading day of September, following Monday's closure due to the Labor Day...

China’s BYD gains car market share as Europeans shun Musk

NEW YORK CITY, New York: Europeans are turning away from Elon Musk and his cars, despite his prediction of a major rebound in Tesla...

Microsoft dismisses workers involved in Gaza-related demonstrations

REDMOND, Washington: Microsoft has dismissed four employees after on-site protests against the company's ties to Israel, escalating...

Trump ends de minimis exemption, Shein and Temu among firms hit

NEW YORK CITY, New York: U.S. shoppers who have grown used to ordering cheap goods from overseas will soon see higher prices at checkout....

Nike cuts less than 1% of corporate staff in global business reset

BEAVERTON, Oregon: Nike said it will trim fewer than one percent of its corporate workforce, a modest round of cuts that comes as the...

GE Aerospace hit by UAW strike at two key facilities

EVENDALE, Ohio: A contract standoff has triggered a walkout at GE Aerospace, with more than 600 United Auto Workers union members striking...