Wall Street kicks off September with a limp,

Big News Network.com

03 Sep 2025, 01:43 GMT+10

- U.S. stocks fell Tuesday, the first trading day of September, following Monday's closure due to the Labor Day holiday.

- President Trump conceded Tuesday's stock market falls were due to the court ruling that his tariffs were illegal.

- "Without tariffs, we have an entirely different country,” he told reporters.

NEW YORK, New York - U.S. stocks fell Tuesday, the first trading day of September, following Monday's closure due to the Labor Day holiday. With uncertainty surrounding President Donald Trump's trade tariffs due to a court ruling, and continuing concern over the president's attempts to take control of the Federal Reserve, unnerved investors and traders.

Trump conceded Tuesday's stock market falls were due to the court ruling that his tariffs were illegal. The administration has launched an appeal against the decision. "Without tariffs, we have an entirely different country," he told reporters. He referred to the situation as "an economic emergency."

"If we don't win that decision, you'll see a reverberation like maybe you've never seen before," he told CNN radio.

U.S. stocks closed lower on Tuesday, with all three major Wall Street indices retreating as technology shares led a broad-based selloff.

The Standard and Poor's 500 fell 45.84 points, or 0.71 percent, to finish at 6,414.42, snapping a brief two-day winning streak. The decline came as investors digested new economic data suggesting inflation pressures remain persistent, potentially delaying any Federal Reserve pivot toward easing.

The Dow Jones Industrial Average also declined, shedding 270.18 points, or 0.59 percent, to close at 45,274.70. Defensive sectors showed relative strength, but weakness in industrials and financials kept the blue-chip index in negative territory.

Meanwhile, the NASDAQ Composite posted the steepest loss among the major U.S. benchmarks, dropping 168.62 points, or 0.79 percent, to end at 21,286.93. High-growth tech stocks came under pressure as bond yields ticked higher, with semiconductors and cloud computing firms leading the retreat.

Tuesday's U.S. Stocks Market Summary

| Index | Closing Level | Change | Percent Move |

|---|---|---|---|

| S&P 500 | 6,414.42 | −45.84 | −0.71 percent |

| Dow Jones Industrial Avg. | 45,274.70 | −270.18 | −0.59 percent |

| NASDAQ Composite | 21,286.93 | −168.62 | −0.79 percent |

U.S. Dollar Rebounds in Tuesday FX Trading as Euro and Pound Tumble

The U.S. dollar advanced against most major currencies on Tuesday, buoyed by rising Treasury yields and cautious sentiment in global markets. Traders appeared to seek safety in the greenback as UK and European currencies faced renewed selling pressure and commodity-linked currencies lost ground.

The euro (EUR/USD) slipped 0.61 percent to 1.1639, continuing its recent downward trend amid soft Eurozone inflation data and mounting concerns over economic growth. Meanwhile, the British pound (GBP/USD) experienced the steepest decline of the day, dropping 1.14 percent to 1.3388, as weak UK manufacturing figures weighed on investor confidence.

In Asia, the U.S. dollar (USD/JPY) rose 0.79 percent to 148.33 yen, reflecting divergent monetary policy expectations between the Federal Reserve and the Bank of Japan. The yen's slide continued despite Japanese officials warning of excessive currency volatility.

Among the commodity currencies, the Australian dollar (AUD/USD) fell 0.49 percent to 0.6519, while the New Zealand dollar (NZD/USD) declined 0.52 percent to 0.5864, both pressured by lower demand forecasts from China and retreating global risk appetite.

The U.S. dollar also climbed against the Canadian dollar (USD/CAD), gaining 0.23 percent to reach 1.3782, supported by a drop in crude oil prices and cautious sentiment ahead of the Bank of Canada's policy decision.

Elsewhere, the greenback strengthened against the Swiss franc (USD/CHF), advancing 0.56 percent to 0.8047, as investors rotated into dollar-denominated assets amid continued geopolitical uncertainty in Europe.

FX Market Summary – Tuesday 2 September 2025

| Currency Pair | Closing Rate | Daily Move |

|---|---|---|

| EUR/USD | 1.1639 | −0.61 percent |

| USD/JPY | 148.33 | +0.79 percent |

| USD/CAD | 1.3782 | +0.23 percent |

| GBP/USD | 1.3388 | −1.14 percent |

| USD/CHF | 0.8047 | +0.56 percent |

| AUD/USD | 0.6519 | −0.49 percent |

| NZD/USD | 0.5864 | −0.52 percent |

The overall tone in FX markets was risk-averse, with the U.S. dollar standing firm as traders reassessed interest rate trajectories and awaited key U.S. economic data later in the week. Analysts expect continued volatility.

Global Stock Markets Report – Tuesday Close - German Dax Tumbles

Tuesday's global trading landscape was marked by widespread declines, particularly pronounced in European and select Asia and Pacific markets. Brussels and Tel Aviv also saw sharp declines. Germany's DAX however led the falls with a steep 2.29 percent retreat, while only a handful of indices such as Singapore's STI, Indonesia's IDX Composite, New Zealand's NZX 50, and South Korea's KOSPI posted gains.

In Australia, both major indices slipped modestly, and in China, the Shanghai Composite mirrored the broader Asia-Pacific caution with a notable slide on heavy volume. Overall, the session underscored heightened investor risk aversion.

Canadian Markets

- The S&P/TSX Composite Index rose 50.49 points, or 0.18 percent, to finish at 28,614.94

UK and European Markets

-

FTSE 100 in London closed at 9,116.69, down 79.65 points, a fall of 0.87 percent.

-

DAX (Germany) ended at 23,487.33, declining 550.00 points, or 2.29 percent, marking the steepest drop among the region's benchmarks.

-

CAC 40 (France) settled at 7,654.25, down 53.65 points, a 0.70 percent decrease.

-

EURO STOXX 50 closed at 5,291.04, dropping 76.04 points, or 1.42 percent.

-

Euronext 100 (N100) finished at 1,575.17, off 17.07 points, representing a 1.07 percent decline

Asia and Pacific Markets

-

Nikkei 225 closed via overnight futures at 42,310.49, gaining 121.70 points, or 0.29 percent.

-

Hang Seng Index (Hong Kong) closed at 25,496.55, down 120.87 points, or 0.47 percent.

- Shanghai Composite finished at 3,858.13, dipping 17.40 points, a 0.45 percent retreat on 3.247 billion in turnover.

-

STI (Singapore) surged to 4,298.51, up 22.44 points, a gain of 0.52 percent—the lone gainer in APAC.

-

S&P/ASX 200 (Australia) ended at 8,900.60, down 27.10 points, a 0.30 percent decrease.

-

All Ordinaries (Australia) closed at 9,168.00, falling 28.80 points, or 0.31 percent.

-

S&P/NZX 50 (New Zealand) climbed to 13,133.16, increasing by 62.71 points, or 0.48 percent.

-

S&P BSE Sensex (India) finished at 80,157.88, down 206.61 points, a 0.26 percent drop.

-

IDX Composite (Indonesia) rose to 7,801.58, up 65.52 points, adding 0.85 percent.

-

FTSE Bursa Malaysia KLCI nudged up to 1,576.70, gaining 1.58 points, or 0.10 percent.

- KOSPI (South Korea) rose to 3,172.35, up 29.42 points, marking a 0.94 percent gain.

- TWSE Capitalization Weighted Index (Taiwan) dropped to 24,016.78, down 54.95 points, or 0.23 percent

Africa

-

JSE Top 40 (Johannesburg) closed at 5,694.74, down 65.84 points, or 1.14 percent.

Middle East Markets

-

TA‑125 (Israel) closed at 3,050.76, declining 47.57 points, a 1.54 percent fall.

-

EGX 30 Price Return Index (Egypt) barely moved at 35,156.90, down only 2.00 points, or 0.01 percent; trading volume stood at approximately 104.56 million.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dallas Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dallas Sun.

More InformationInternational

SectionPhone call with Cambodia costs Thailand’s PM Shinawatra her post

BANGKOK, Thailand: Thailand's Constitutional Court has removed Prime Minister Paetongtarn Shinawatra from office, ruling that she broke...

Envoys return as India-Canada relations mend after Nijjar killing

OTTAWA, Canada: India and Canada have restored diplomatic ties by appointing new high commissioners to each other's capitals, ending...

“Do no harm”: Three top CDC officials resign over vaccine concerns

WASHINGTON, D.C.: Three senior officials at the U.S. Centers for Disease Control and Prevention resigned this week, citing deep concerns...

Wife of ousted South Korean president, ex-PM indicted

SEOUL, South Korea: South Korea's former First Lady Kim Keon Hee and ex-Prime Minister Han Duck-soo were both indicted on August 29...

Verdict of media tycoon Jimmy Lai to be announced at later date

HONG KONG: A Hong Kong court has said it will announce the verdict in media tycoon Jimmy Lai's national security trial at a later date,...

Landslides in Kashmir leave pilgrims missing, floods in Pakistan

NEW DELHI/ISLAMABAD: Torrential rains pounding parts of Pakistan and India have left a trail of destruction, killing at least 34 people...

Business

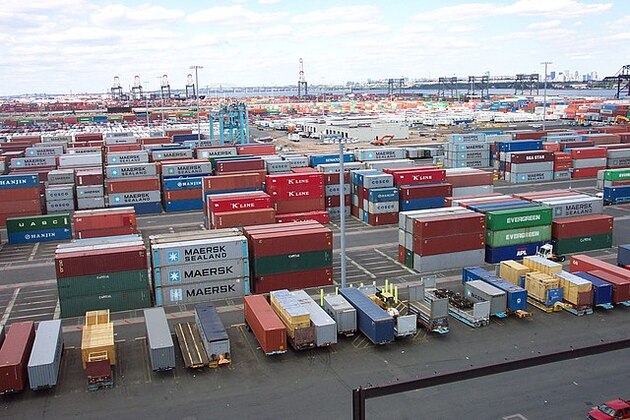

SectionAppeals court strikes down Trump tariffs, but keeps them in place now

NEW YORK CITY. New York: A U.S. appeals court has delivered a significant blow to one of President Donald Trump's signature economic...

Wall Street kicks off September with a limp,

NEW YORK, New York - U.S. stocks fell Tuesday, the first trading day of September, following Monday's closure due to the Labor Day...

China’s BYD gains car market share as Europeans shun Musk

NEW YORK CITY, New York: Europeans are turning away from Elon Musk and his cars, despite his prediction of a major rebound in Tesla...

Microsoft dismisses workers involved in Gaza-related demonstrations

REDMOND, Washington: Microsoft has dismissed four employees after on-site protests against the company's ties to Israel, escalating...

Trump ends de minimis exemption, Shein and Temu among firms hit

NEW YORK CITY, New York: U.S. shoppers who have grown used to ordering cheap goods from overseas will soon see higher prices at checkout....

Nike cuts less than 1% of corporate staff in global business reset

BEAVERTON, Oregon: Nike said it will trim fewer than one percent of its corporate workforce, a modest round of cuts that comes as the...