Wall Street climbs as U.S. dollar sldies Monday

Lola Evans

09 Sep 2025, 01:41 GMT+10

- The tech-heavy NASDAQ Composite led the advance among the major U.S. benchmarks, gaining 98.31 points, or 0.45 percent, to close at 21,798.70.

- The blue-chip Dow Jones Industrial Average added 114.09 points, an increase of 0.25 percent, settling at 45,514.95.

- The Standard and Poor's 500, a broad gauge of the U.S. market, also posted a gain, rising 13.65 points, or 0.21 percent, to finish the session at 6,495.15.

NEW YORK, New York - U.S. stocks opened the new week with solid across-the-board gains on Monday, with the Nasdqaq Compoiste hitting a new record high.

"U.S. stocks have recorded a string of all-time highs in recent weeks, supported by a better-than anticipated second-quarter earnings season, with strong results from AI-exposed companies, and a higher likelihood of a Federal Reserve rate cut in September," David Lefkowitz of UBS Global Wealth Management said in note to clients on Monday.

"We think the equity bull market has further to run and expect the S&P 500 to reach 6,800 by June 2026," he said.

Major U.S. stock indices closed modestly higher, extending their recent record-setting run.

The tech-heavy NASDAQ Composite led the advance among the major U.S. benchmarks, gaining 98.31 points, or 0.45 percent, to close at 21,798.70. The index continued to be propelled by strength in the technology sector.

The Standard and Poor's 500, a broad gauge of the U.S. market, also posted a gain, rising 13.65 points, or 0.21 percent, to finish the session at 6,495.15. The blue-chip Dow Jones Industrial Average added 114.09 points, an increase of 0.25 percent, settling at 45,514.95.

The day's gains were broad-based, reflecting continued investor confidence amid expectations for future interest rate cuts. The positive momentum pushed the S&P 500 and Nasdaq to fresh all-time closing highs.

U.S. Dollar Dips Again in Monday's Trading as Commodity Currencies Rally

The U.S. dollar turned in a poor performance during Monday's foreign exchange session, softening against major European and commodity-linked currencies while holding steady against the Japanese yen.

Despite the political turmoil in France, the euro was a notable gainer, with EUR/USD climbing 0.39 percent to trade at 1.1763. The British pound also advanced against the greenback, with GBP/USD rising 0.34 percent to 1.3552.

The day's most significant moves, however, were seen in the commodity bloc. The Australian dollar led the charge, as AUD/USD surged 0.67 percent to 0.6594. The New Zealand dollar followed closely behind, with NZD/USD jumping 0.88 percent to 0.5941, making it the session's top performer among major pairs.

In contrast, the U.S. dollar found little momentum elsewhere. The USD/JPY pair was virtually unchanged, flat at 147.34 yen. The greenback saw slight losses against the Canadian dollar, with USD/CAD dipping 0.11 percent to 1.3807.

The most pronounced decline for the dollar was against the Swiss franc, often viewed as a haven currency. The USD/CHF pair fell 0.60 percent to 0.7930.

The session's activity painted a picture of a modestly weaker U.S. dollar as traders showed increased appetite for risk-sensitive and commodity-driven currencies. The strong showing from the Antipodean dollars, in particular, suggested a positive shift in global risk sentiment to start the trading week. Market participants are now looking ahead to key economic data releases and central bank commentary for further direction on currency trends.

European and Asian Markets Mostly Higher to Start the Week

Global equity markets kicked off the week with a predominantly positive tone on Monday, as major European indices posted solid gains and most Asian benchmarks followed suit, though trading was mixed across the region.

In Europe, the rally was broad-based. Germany's DAX led the charge, climbing 210.13 points, or 0.89 percent, to close at 23,807.13. France's CAC 40 was also a strong performer, advancing 60.06 points, or 0.78 percent, to finish at 7,734.84.

The pan-European EURO STOXX 50 index rose 44.66 points, or 0.84 percent, settling at 5,362.81. The Euronext 100 Index gained 11.67 points, a rise of 0.74 percent, to end the day at 1,594.12.

Britain's FTSE 100 saw a more modest increase, edging up 13.23 points, or 0.14 percent, to close at 9,221.44. Belgium's BEL 20 also finished in positive territory, adding 24.87 points, or 0.52 percent, to 4,793.69.

Canada's S&P/TSX Composite Index finished slightly lower. The index dipped 22.90 points, or 0.08 percent, to close at 29,027.73. The marginal decline suggests a divergence in sector performance from its U.S. counterparts, potentially weighed down by specific commodity prices.

In Asia, performance was varied but largely optimistic. Japan's Nikkei 225 was a standout, surging 625.06 points, or 1.45 percent, to close at 43,643.81. Hong Kong's Hang Seng Index recorded a strong gain of 215.93 points, or 0.85 percent, finishing at 25,633.91.

South Korea's KOSPI rose 14.47 points, or 0.45 percent, to 3,219.59, while Taiwan's TWSE added 52.80 points, or 0.22 percent, closing at 24,547.38. New Zealand's S&P/NZX 50 climbed 57.61 points, or 0.44 percent, to 13,281.14.

China's SSE Composite Index gained 14.33 points, an increase of 0.38 percent. India's S&P BSE Sensex eked out a modest gain of 76.54 points, or 0.09 percent, to close at 80,787.30.

However, not all markets shared in the gains. Australia's S&P/ASX 200 dipped 21.60 points, or 0.24 percent, to 8,849.60, and the broader All Ordinaries index slipped 13.60 points, or 0.15 percent, to 9,126.90. Indonesia's IDX Composite was the session's notable decliner, falling 100.50 points, or 1.28 percent, to 7,766.85.

Conversely, Egypt's EGX 30 rose 146.10 points, or 0.42 percent, and South Africa's Top 40 USD Net TRI Index jumped 93.30 points, or 1.62 percent.

The day's mixed but generally positive performance sets the stage for a busy week ahead, with investors keenly awaiting key economic data and central bank signals for further direction.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dallas Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dallas Sun.

More InformationInternational

SectionNepal PM resigns as protesters storm parliament

KATHMANDU, Nepal: Prime Minister K. P. Sharma Oli has resigned amid the violence that continued for a second day Tuesday, which saw...

Israel to intensify operations in Gaza, West Bank and wider region

JERUSALEM - Israeli Prime Minister Benjamin Netanyahu has vowed to continue his country's war in Gaza, and in Jerusalem, following...

Severe floods and landslides ravage Himalayan states in India

NEW DELHI, India: At least 90 people have lost their lives and hundreds more have been displaced as unrelenting monsoon rains continue...

Bullfighting and cockfighting to be banned in Colombia by 2028

BOGOTA, Colombia: Colombia's Constitutional Court on September 4 upheld a 2024 law banning bullfights across the country, while going...

Trump admin vows strict enforcement of foreign worker rules

WASHINGTON, D.C.: The White House defended a major raid at a Hyundai facility in Georgia, saying it underscored the Trump administration's...

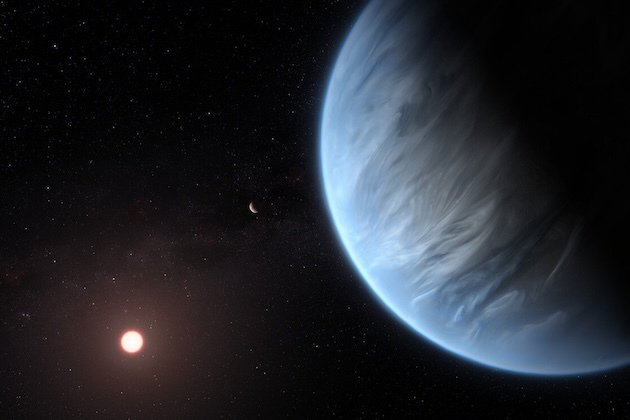

Discover of K2-18b spurs a new hope for alien life

A wave of excitement and rigorous skepticism continues to sweep through the astronomical community following a series of groundbreaking...

Business

SectionIshiba’s exit sinks yen, U.S. jobs slump boosts Fed rate cut calls

SINGAPORE: The yen has stabilized after investors digested the shock resignation of Japanese Prime Minister Shigeru Ishiba. This development...

GLP-1s join WHO essential medicines list, raising access hopes

LONDON, U.K.: The World Health Organization has expanded its list of critical medicines to include a new class of diabetes treatments...

Trump urges patience as weak jobs data clash with economic pledges

WASHINGTON, D.C.: Seven months into Donald Trump's return to the White House, the economic picture he promised to restore is looking...

Wall Street climbs as U.S. dollar sldies Monday

NEW YORK, New York - U.S. stocks opened the new week with solid across-the-board gains on Monday, with the Nasdqaq Compoiste hitting...

Tesla’s Texas shift paves way for Musk’s unprecedented pay deal

WILMINGTON, Delaware: Elon Musk's latest pay deal at Tesla shows how dramatically the rules of the game can change depending on where...

Kathmandu shuts access to unregistered social media platforms

KATHMANDU, Nepal: Nepal's government announced this week that it is blocking access to most major social media platforms — including...