Dow Jones jumps 197 points as demand for stocks continue

Lola Evans

10 Sep 2025, 01:44 GMT+10

- The Dow Jones Industrial Average (^DJI) led the charge, posting a solid gain of 196.64 points, or 0.43 percent, to close at 45,711.59.

- The tech-heavy NASDAQ Composite (^IXIC) also reached higher, adding 80.79 points to finish the session at 21,879.49, an increase of 0.37 percent.

- The broader S&P 500 (^GSPC), a key benchmark for the U.S. market, rose 17.50 points to settle at 6,512.65, a gain of 0.27 percent.

NEW YORK, New York - U.S. equity markets climbed steadily on Tuesday, pushing all three major indices into positive territory as investor optimism continued to fuel a broad-based rally.

The Dow Jones Industrial Average (^DJI) led the charge, posting a solid gain of 196.64 points, or 0.43 percent, to close at 45,711.59. The blue-chip index's advance was powered by gains across a diverse range of sectors.

The tech-heavy NASDAQ Composite (^IXIC) also reached higher, adding 80.79 points to finish the session at 21,879.49, an increase of 0.37 percent. The rally demonstrated strength beyond the mega-cap technology stocks that have often driven its performance.

The broader S&P 500 (^GSPC), a key benchmark for the U.S. market, rose 17.50 points to settle at 6,512.65, a gain of 0.27 percent. The index traded within striking distance of its own intraday record, reflecting widespread positive sentiment.

The day's advance marks a continuation of the market's strong upward trend, with investors seemingly looking past geopolitical tensions and focusing instead on resilient corporate earnings and expectations for stable economic policy. The sustained climb back suggests a robust underlying confidence in the health of the North American economy.

U.S. Dollar Shows Strength in Tuesday Trading

The U.S. dollar rebounded against a basket of major currencies on Tuesday, strengthening against commodity-linked currencies and the Swiss franc but but remaining flat against the Japanese Yen.

The greenback found solid footing against its Canadian counterpart. The USDCAD pair rose to 1.3855, gaining 0.38 percent on the day.

The dollar also posted significant strength against the Swiss franc. The USDCHF pair advanced 0.57 percent to 0.7976, marking one of the day's strongest performances for the US currency.

However, the dollar's strength was not universal. It saw a marginal decline against the Japanese Yen (USDJPY), dipping 0.01 percent to 147.44.

The Euro (EURUSD) managed to hold ground, though it remained under pressure. The common currency was last seen at 1.1705 against the dollar, down 0.49 percent for the session. Analysts pointed to lingering concerns over the Eurozone's economic outlook as a continuing headwind.

The British Pound (GBPUSD) also edged lower, falling 0.17 percent to trade at 1.3520. Market participants were cautious ahead of key UK economic data releases later in the week.

In the Pacific, the commodity-sensitive Australian Dollar (AUDUSD) softened by 0.11 percent to 0.6584. Similarly, the New Zealand Dollar (NZDUSD) saw a more pronounced decline, falling 0.25 percent to 0.5924. The losses were attributed to a broader risk-off sentiment and a stronger U.S. dollar in certain pairings.

Overall, the dollar's solid performance reflected a market in search of a clear direction, balancing divergent central bank policies and global growth concerns. Traders are now looking ahead to key inflation data and central bank meeting minutes for their next major cues.

Global Markets Show Mixed Results as Asia and Pacific Shares Lead Gains

Global equity markets delivered a mixed performance on Tuesday, with major European indices finishing slightly higher while several Asia-Pacific benchmarks posted strong gains, led by a surge in Taiwan and South Korea.

Canada's main stock index finished in positive territory, though its gains were modest. The S&P/TSX Composite (^GSPTSE) edged higher by 35.28 points, or 0.12 percent, closing at 29,063.01.

In London, the FTSE 100 (^FTSE) edged upward, closing at 9,242.53, a gain of 21.09 points or 0.23 percent. The index spent the day trading within a narrow range as investors assessed the latest economic data.

Continental European markets were more subdued. Germany's DAX (^GDAXI) retreated from recent highs, closing at 23,718.45, down 88.65 points or 0.37 percent. France's CAC 40 (^FCHI) managed a modest gain, adding 14.55 points to finish at 7,749.39, up 0.19 percent.

Broader European indices also saw minor movements. The EURO STOXX 50 (^STOXX50E) rose 6.01 points to 5,368.82, an increase of 0.11 percent. The Euronext 100 Index (^N100) outperformed its regional peers, climbing 6.50 points, or 0.41 percent, to settle at 1,600.62. Belgium's BEL 20 (^BFX) advanced 12.67 points, or 0.26 percent, closing at 4,806.36.

Asia and Pacific Markets Rally

The trading day in Asia was notably stronger. Hong Kong's Hang Seng Index (^HSI) jumped 304.22 points, or 1.19 percent, to close at 25,938.13. Taiwan's TWSE Index (^TWII) was a standout performer, soaring 307.80 points, or 1.25 percent, to 24,855.18.

Mainland China's SSE Composite Index closed at 3,807.29, down 19.55 points or 0.51 percent.

South Korea's KOSPI (^KS11) also had a strong session, gaining 40.46 points, or 1.26 percent, to finish at 3,260.05.

The performance was not uniform across the region, however. Australia's S&P/ASX 200 (^AXJO) fell 46.10 points, or 0.52 percent, to 8,803.50. The broader All Ordinaries index (^AORD) followed suit, dropping 0.51 percent to 9,080.70. Singapore's STI Index (^STI) slipped 0.25 percent to 4,297.57.

Japan's Nikkei 225 (^N225) took a pause from its recent record run, closing at 43,459.29, down 184.52 points or 0.42 percent.

Other Global Moves

India's BSE SENSEX (^BSESN) continued its record-breaking climb, adding 314.02 points, or 0.39 percent, to close at a new high of 81,101.32.

In contrast, Indonesia's IDX Composite (^JKSE) was one of the session's weakest performers, tumbling 138.24 points, or 1.78 percent, to 7,628.60.

Malaysia's FTSE Bursa Malaysia KLCI (^KLSE) was nearly flat, eking out a gain of just 0.08 percent to end at 1,586.81. New Zealand's S&P/NZX 50 (^NZ50) also finished slightly lower, down 0.21 percent at 13,253.73.

In the Middle East, Israel's TA-125 (^TA125.TA) surged 53.50 points, or 1.70 percent, to close at 3,204.15. Egypt's EGX 30 (^CASE30) was a notable decliner, falling 215.20 points, or 0.62 percent, to 34,386.30.

South Africa's Top 40 USD Net TRI Index (^JN0U.JO) advanced 0.61 percent to 5,888.12.

Related story;

Monday 8 September 2025 | U.S. stocks forge ahead in start to new week, Dow Jones up 114 points | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dallas Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dallas Sun.

More InformationInternational

SectionIsrael shatters hostages hopes with assassination attempts on negotiators

DOHA, Qatar - In a significant and dramatic escalation that has sent shockwaves through the Middle East, the Israeli military has confirmed...

Nepal PM resigns as protesters storm parliament

KATHMANDU, Nepal: Prime Minister K. P. Sharma Oli has resigned amid the violence that continued for a second day Tuesday, which saw...

Israel to intensify operations in Gaza, West Bank and wider region

JERUSALEM - Israeli Prime Minister Benjamin Netanyahu has vowed to continue his country's war in Gaza, and in Jerusalem, following...

Severe floods and landslides ravage Himalayan states in India

NEW DELHI, India: At least 90 people have lost their lives and hundreds more have been displaced as unrelenting monsoon rains continue...

Bullfighting and cockfighting to be banned in Colombia by 2028

BOGOTA, Colombia: Colombia's Constitutional Court on September 4 upheld a 2024 law banning bullfights across the country, while going...

Trump admin vows strict enforcement of foreign worker rules

WASHINGTON, D.C.: The White House defended a major raid at a Hyundai facility in Georgia, saying it underscored the Trump administration's...

Business

SectionTime to make privacy protection a priority

In today's world, protecting your personal information feels like an uphill battle. With the rise of sophisticated email and text scams,...

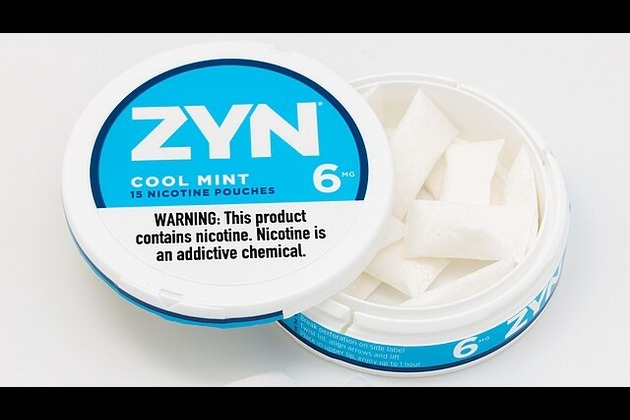

Nicotine pouches from top tobacco firms set for faster FDA review

WASHINGTON, D.C.: The U.S. Food and Drug Administration is preparing to fast-track reviews of nicotine pouches from four major tobacco...

Dow Jones jumps 197 points as demand for stocks continue

NEW YORK, New York - U.S. equity markets climbed steadily on Tuesday, pushing all three major indices into positive territory as investor...

After Hyundai raid, Trump calls for U.S. jobs from foreign firms

WASHINGTON, D.C.: President Donald Trump said foreign companies investing in the United States must prioritize hiring and training...

Ishiba’s exit sinks yen, U.S. jobs slump boosts Fed rate cut calls

SINGAPORE: The yen has stabilized after investors digested the shock resignation of Japanese Prime Minister Shigeru Ishiba. This development...

GLP-1s join WHO essential medicines list, raising access hopes

LONDON, U.K.: The World Health Organization has expanded its list of critical medicines to include a new class of diabetes treatments...